It’s another multi-part series here on Life, Love, and Food! You can find Part One of this series, On Weight and Worry, right here.

One of my best and worst qualities is that I’m a sponge for other people’s emotions. It’s a great quality because it makes me very empathetic, and quite often I find myself as the unpaid therapist for needy friends. (Matt tells me I should raise my rates, which I think is very sound advice.) It’s a terrible quality because I absorb other people’s anxieties lickety-split, and it can make me kinda miserable. That’s why I have such an affinity for people who are calm and happy—it’s utterly soothing for me to around them. Interestingly, some of my closest friends have also professed to having a lot of anxiety, but I don’t feel their anxiety when we are together, as though the pleasure of being together makes us both feel better.

Growing up, my father had a lot of anxiety about money. Honestly, with five kids, he had good reason to be anxious about money. Somehow, my parents made it work, and we were neither homeless nor malnourished. I did, however, enter adulthood with mountains of fear about money, both making it and spending it. Having spent six years in graduate school, perhaps my anxiety was also well-placed, much like my father’s. But my anxiety is more squirrely than good intentions to save more and spend less. I can get anxious about other people’s money too, to the point where I feel almost panicked by their finances. It’s absurd, really, because how much do we really know about someone else’s finances? Not much, unless we are their accountant or the federal government. Still, my anxiety about money has loomed large for most of my life, and it exhausts me.

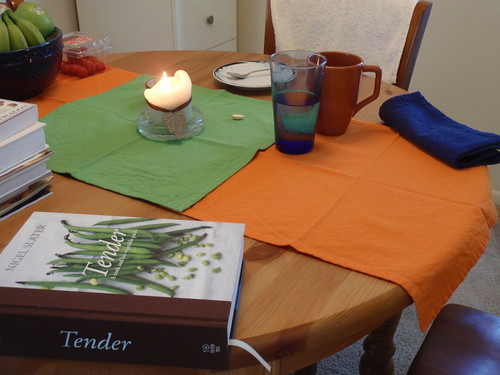

As a graduate student, I received a very reasonable stipend. It was more than enough to live on, and I made it my goal to save what I could. I kept careful track of my expenditures, and I was able to save about $200-300 a month, which is not too shabby at all for a student. Of course I wish I’d been able to save more, but I loved what I chose to spend my money on: a spacious apartment; really great food, cookbooks; tickets to Michigan, Arizona, California; birthday and Christmas presents. I had enough money to eat out once or twice a month, enough money to enjoy the city where I was living. I certainly didn’t have enough money to purchase a home when I was in graduate school, but I set up retirement accounts and planned for a good future while living within my means during the present. I wasn’t particularly anxious about money during graduate school because I was too anxious about graduate school itself and what my career prospects would look like.

As I’ve been out of grad school and working, my attitude about money has shifted. I make more money now, and I spend more money too. Some of that spending doesn’t feel optional, such as plane tickets north to see my family. It’s expensive to travel out of College Station. But for the most part, I have adhered to the same budget I followed in graduate school, which looks a little like this for any given month:

* Rent, utilities, and phone: ~$1100-1200

* Food (groceries and eating out): ~$300

* Travel and monthly extras: ~$300

“Monthly extras” can be anything from presents to Target trips to new clothing to bike repair bills. It’s really my catch-all category for the expenditures that appear sporadically. For travel, I usually budget $100 per month for the 2-3 trips I take each year, and if I get a tax return, it goes into my travel budget.

If you do the math, my budget adds up to $1700-1800 spent each month. But during most months, I’m able to keep my spending around $1600. I also have what I call my “Rainy Day Money,” which is basically money that’s been given to me as gifts. Because it was gifted, I tend to use it for treats like a fancy meal at Veritas with my favorite gentleman or a new dress. So I suppose it’s fair to say that I probably spend between $1600 and $1700 a month—the Rainy Day Money gives my budget some flexibility, and it allows me to put gift money to good use by not spending it on boring things like rent and groceries.

A budget, money-tracking, gifts—this is all very rational when it comes to money. It’s rational behavior. But I don’t always feel rational about money—my anxiety lies in wait like a snake in the grass, hissing to itself and ready to rear up when the opportunity arrives. This summer, when I was presented with the possibility of no longer having a job in a few months, my anxieties about money loomed large. What would I do if I lost my job? What should I do right now, in case I lose my job? Should I clamp down on my budget, pinching pennies so hard they howl in pain? Should I start baking my own bread and eating lentil soup at every meal? Should I start calculating the cost-per-meal value of my recipes?

Or…should I take a deep breath and try to consider what’s really important here?

Of course I could have launched a Save Every Penny campaign, preparing for joblessness in the near future. When I tried to think about what really mattered to me, I realized that I needed to do my best to keep this job. Financially, staying in my current job is the right thing for right now. I wasn’t ready to give up on this job or on the projects that I’d been nurturing in said job. I also realized that clamping down on my spending would actually make it harder to stay focused on the job, because I’d be worried and distracted by money at a time when I really wanted to focus on my work.

So I let go, at least a little bit. I bought bottles of wine when I was in the mood for wine with dinner, and I bought bars of chocolate to keep in the pantry for emergencies. On Saturday afternoons, after spending the morning in the lab, I sometimes took myself out to lunch, a little treat for all my hard work. And indeed it was a treat to have someone else make my lunch for me—it made my life a little easier, a little more light-hearted. I thought about this piece by Lauren Slater, in which she writes,

“I've always been a tightfisted misanthrope, someone whose fears—of going broke, of ending up sleeping on the street—made it difficult to buy things for my family and for myself. So for a year, as an experiment, I became a casual consumer, zooming through Target and my other favorite stores, piling my cart high. I bought what I wanted, only to find at year's end that even at my most extreme, I am not all that extreme. I have limits.”

(Scroll down to the second essay in that collection to find Lauren Slater’s piece. It’s worth reading!)

That piece, which I first read years ago, resonated with me. Aha! I thought. Now here is a woman after my own heart. We shared the same fears, the same anxieties about money. And it turned out that the solution for both of us may have been to let go and see what happened when we hit the ground. Looking at my spending journal now, I see that for June, July, and August combined, I spent about $80 more than my usual numbers. When I check my Rainy Day Log, I see that I didn’t spend any of that money, which means all my extras—shoes and new clothes and a dinner at Veritas and on and on—all of these things were noted and accounted for in my monthly spending.

The cost of my letting go was eighty dollars. Eighty dollars! That’s a ludicrously small amount of money considering the chokehold that money often has over my psyche. I am stunned and awed.

I’m also grateful. I don’t like that I inherited my dad’s anxiety about money, but I am grateful that because of that anxiety, I can sit here right now and account for almost every penny I spent. And I know now that buying a few bottles of wine won’t break my budget. Buying new shoes, even a pair that is, arguably, a bit frivolous—that won’t break my budget. Saying “yes” to pleasure more often will not break my budget because I know now that I too have limits. I love an evening at Veritas or even just a glass of wine and a cheese plate as a treat, but I don’t want to go there every day or even every week. Part of what makes spending fun is that I don’t indulge in these bigger treats every day or even every week.

But the peace of mind I feel from this little experiment of mine—I can enjoy that every day. There’s nothing quite as satisfying or humbling as facing your fears and realizing that they weren’t nearly as bad as you thought they were.

* * *

I feel like before I go, I should issue a little disclaimer about this post. By no means am I trying to complain about my money situation, argue that I don’t make enough money, or even claim that I live frugally. I live in a way that works for me. I save money where it makes sense for me (which is why I don’t have a car, even in Texas!), and I spend money the same way. It’s my hope that by sharing specific numbers with you, I can give you an idea of how I budget and what a month looks like in my financial life. But the real obstacle for me, when it comes to money, is my own attitude toward it, and that’s what I’ve tried to explore in this post. I hope that this post will resonate with a few of you, even just a little.

Thanks for reading, as always. I really do have the best readers!